What Can Be Collateral for a Loan

Introduction

When applying for a loan, one of the common requirements that lenders ask for is collateral. Collateral is something of value that you pledge to the lender to secure the loan. In case you are unable to repay the loan, the lender can take possession of the collateral to recover their losses. But what exactly can be used as collateral for a loan? Let’s explore the different types of collateral that lenders accept.

What Do You Mean by Collateral?

Image Source: fastcapital360.com

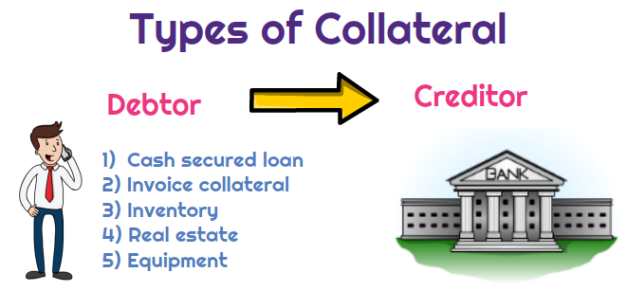

Collateral is a security or guarantee that a borrower offers to a lender when taking out a loan. It provides protection to the lender in case the borrower defaults on the loan. Collateral can be in the form of assets such as Real Estate, vehicles, investments, or valuable personal property.

How Does Collateral Work?

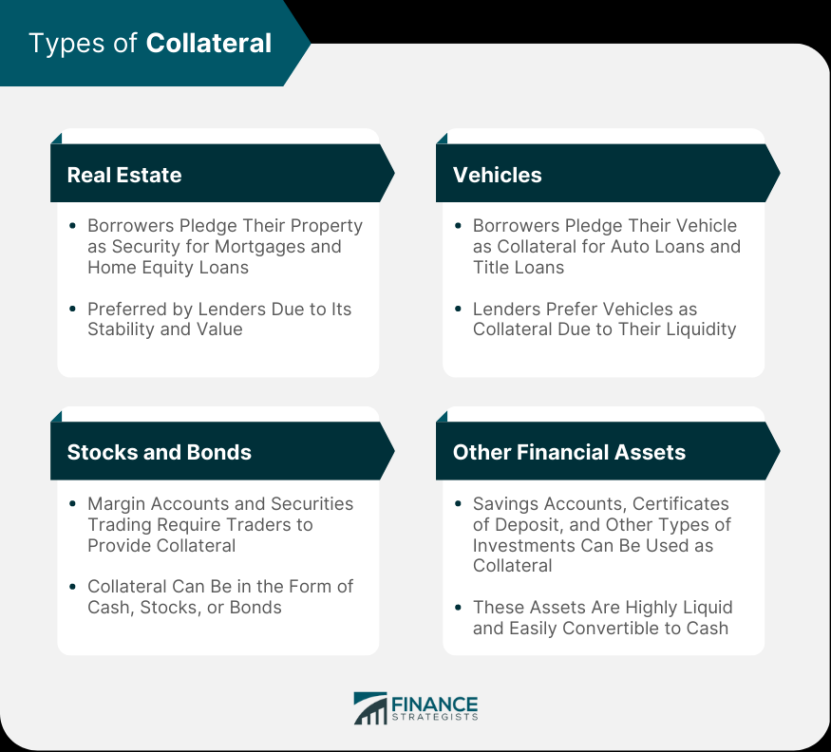

Image Source: financestrategists.com

When you provide collateral for a loan, you are essentially giving the lender the right to take possession of that asset if you fail to repay the loan as agreed. The lender can then sell the collateral to recover the outstanding loan amount. The value of the collateral should be equal to or greater than the loan amount to secure the loan.

What Is Known as Collateral for a Loan?

Image Source: fastcapital360.com

There are various types of assets that can be used as collateral for a loan. Some common forms of collateral include:

Image Source: universalcpareview.com

Real Estate: Properties such as Homes, land, or commercial buildings can be used as collateral for a loan.

Vehicles: Cars, motorcycles, boats, or other vehicles can also be pledged as collateral.

Investments: Stocks, bonds, mutual funds, or other investment accounts can be used as collateral for a loan.

Jewelry: Valuable items such as gold, diamonds, or watches can be used as collateral.

Valuable Personal Property: Antiques, art, collectibles, or other high-value items can be used as collateral for a loan.

Solution for Collateral

When applying for a loan, it is important to carefully consider the type of collateral that you will use. Make sure that the collateral is something of value that you are willing to risk losing if you default on the loan. You should also ensure that the value of the collateral is sufficient to secure the loan amount that you need.

Information to Know

Before using an asset as collateral for a loan, it is important to understand the risks involved. If you are unable to repay the loan, the lender has the right to seize the collateral and sell it to recover their losses. This could result in losing your home, car, or other valuable possessions. It is crucial to carefully read and understand the terms of the loan agreement before pledging any collateral.

Conclusion

Collateral is an important aspect of the loan process, providing security to lenders and allowing borrowers to access funds they need. By understanding what can be used as collateral for a loan and the risks involved, borrowers can make informed decisions when it comes to securing financing. It is essential to carefully consider the type and value of collateral before applying for a loan to ensure that you can meet the repayment terms and avoid losing your assets.

FAQs

1. Can I use my retirement account as collateral for a loan?

Yes, some lenders may accept retirement accounts such as 401(k) or IRA as collateral for a loan, but it is not recommended as it can jeopardize your retirement savings.

2. What happens if I default on a loan with collateral?

If you fail to repay the loan as agreed, the lender has the right to seize the collateral and sell it to recover their losses. This could result in losing the asset you pledged as collateral.

3. Is it possible to use multiple assets as collateral for a single loan?

Yes, some lenders may allow you to use multiple assets as collateral for a loan, especially if the value of one asset is not sufficient to secure the loan amount.

4. Can I use a co-signer instead of collateral for a loan?

Yes, you can use a co-signer who agrees to take responsibility for the loan if you default. A co-signer provides a guarantee to the lender that the loan will be repaid.

5. What is the difference between secured and unsecured loans?

Secured loans require collateral to secure the loan, while unsecured loans do not require collateral but may have higher interest rates.

6. Can I use my business assets as collateral for a personal loan?

Yes, you can use business assets such as equipment, inventory, or accounts receivable as collateral for a personal loan, especially if you are a business owner.

7. How can I determine the value of my collateral for a loan?

You can have the collateral appraised by a professional to determine its current market value. This will help you ensure that the value of the collateral is sufficient to secure the loan amount.

what can be collateral for a loan