Is Earnest Good for Student Loans?

What do you mean by Earnest Student Loans?

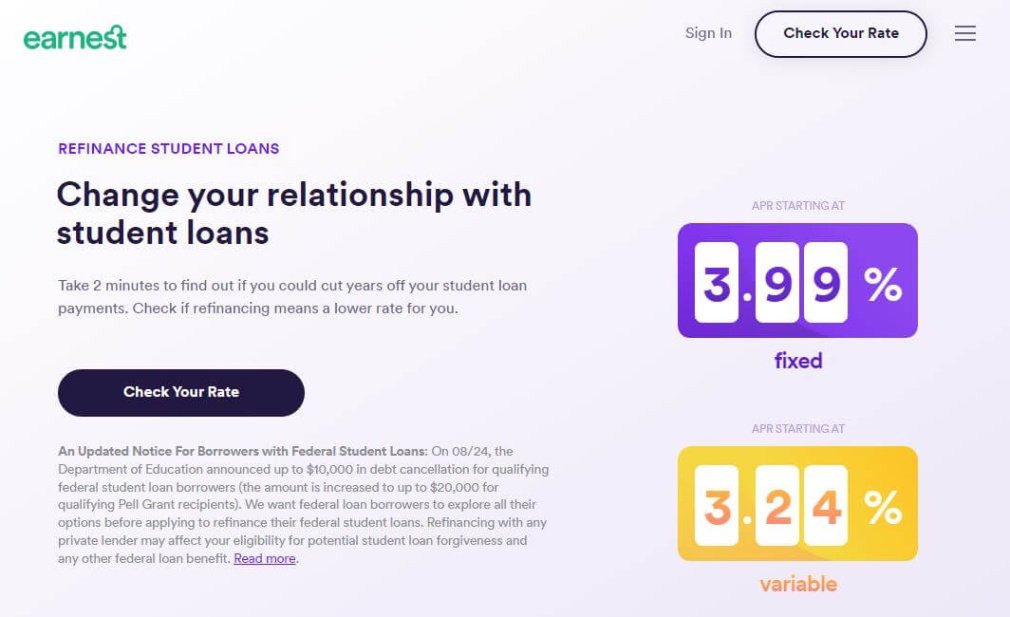

Earnest is a financial company that offers student loan refinancing and private student loans to individuals looking to manage their student debt more effectively. With competitive interest rates and flexible repayment options, Earnest has become a popular choice for students looking to save money on their loans.

How does Earnest Student Loans work?

Image Source: trafficpointltd.com

When you apply for a student loan through Earnest, they will assess your financial situation and credit history to determine the interest rate and terms of your loan. If approved, you will receive the funds to pay off your existing student loans or cover the cost of your education. You will then make monthly payments to Earnest based on the terms of your loan agreement.

What is known about Earnest Student Loans?

Image Source: pcdn.co

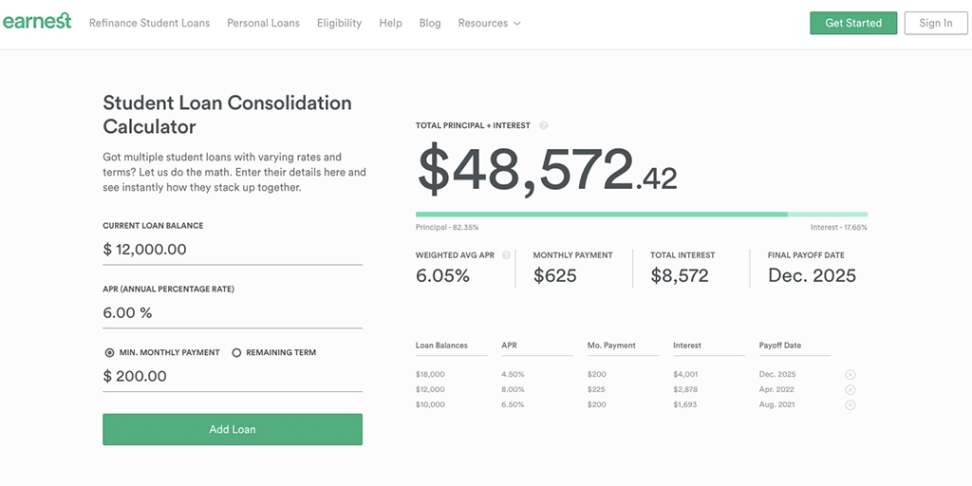

Earnest is known for its customer-centric approach to student lending, offering personalized loan options based on each individual’s financial situation. They also provide tools and resources to help borrowers manage their debt more effectively, such as budgeting tools and repayment calculators.

Is Earnest Student Loans a good option for students?

Image Source: thecollegeinvestor.com

For many students, Earnest can be a good option for refinancing or taking out new student loans. With competitive interest rates and flexible repayment options, Earnest can help students save money and better manage their debt. However, it’s important to compare rates and terms from multiple lenders to ensure you’re getting the best deal for your individual situation.

Solution for Student Loans from Earnest

If you’re struggling to make your student loan payments or looking to save money on interest, refinancing with Earnest could be a good solution. By consolidating your loans into one new loan with a lower interest rate, you can potentially save thousands of dollars over the life of your loan. Additionally, Earnest offers flexible repayment options, such as variable and fixed interest rates, to best meet your financial needs.

Information about Earnest Student Loans

Earnest offers student loan refinancing and private student loans to individuals who meet their eligibility requirements. To qualify for a loan with Earnest, you must have a good credit history, stable income, and be a U.S. citizen or permanent resident. They also consider factors such as your education and job history when determining your eligibility and loan terms.

Why choose Earnest for Student Loans?

There are several reasons why you may choose Earnest for your student loans. They offer competitive interest rates, flexible repayment options, and a customer-centric approach to lending. Additionally, Earnest provides resources and tools to help you manage your debt more effectively, such as budgeting tools and repayment calculators.

Pros and Cons of Earnest Student Loans

Pros: Competitive interest rates, flexible repayment options, customer-centric approach, resources and tools to manage debt.

Cons: Eligibility requirements may be strict, not available in all states, may not offer the lowest rates for all borrowers.

Conclusion

In conclusion, Earnest can be a good option for students looking to refinance or take out new student loans. With competitive interest rates, flexible repayment options, and a customer-centric approach to lending, Earnest provides a valuable service for borrowers looking to better manage their debt. However, it’s important to compare rates and terms from multiple lenders to ensure you’re getting the best deal for your individual situation.

FAQs

1. Can I qualify for an Earnest student loan with bad credit?

Earnest requires borrowers to have a good credit history to qualify for a loan. If you have bad credit, you may need to improve your credit score before applying for a loan with Earnest.

2. How long does it take to get approved for an Earnest student loan?

The approval process for an Earnest student loan can vary depending on your financial situation and credit history. In some cases, you may be approved within a few days, while in others, it may take longer.

3. Are there any fees associated with Earnest student loans?

Earnest does not charge any fees for origination, prepayment, or late payments on their student loans. This can help you save money on your loan compared to other lenders who may charge fees.

4. Can I refinance both federal and private student loans with Earnest?

Yes, Earnest allows borrowers to refinance both federal and private student loans into one new loan with potentially lower interest rates and more favorable terms.

5. How much can I borrow with an Earnest student loan?

The amount you can borrow with an Earnest student loan depends on your financial situation and credit history. Earnest offers loan amounts ranging from $5,000 to $500,000, allowing you to borrow what you need to cover your education expenses.

6. Can I apply for an Earnest student loan if I’m still in school?

Yes, Earnest offers student loans for current students as well as graduates looking to refinance their loans. You can apply for a loan with Earnest while you’re still in school to help cover the cost of your education.

7. Does Earnest offer any discounts or incentives for borrowers?

Earnest does not offer traditional discounts or incentives for borrowers, but they do provide competitive interest rates and flexible repayment options to help you save money on your student loans.

is earnest good for student loans