How to Get Private Student Loans Out of Default

What do you mean by defaulting on a private student loan?

Defaulting on a private student loan means that you have failed to make your monthly payments as agreed upon in the loan contract. This can happen for a variety of reasons, such as financial hardship, unemployment, or simply forgetting to make a payment. When you default on a student loan, it can have serious consequences, including damage to your credit score and potential legal action by the lender.

How does defaulting on a private student loan happen?

Image Source: consumerfinance.gov

Defaulting on a private student loan can happen when you fail to make your monthly payments on time. This can happen for a variety of reasons, such as financial hardship, unemployment, or simply forgetting to make a payment. When you default on a student loan, it can have serious consequences, including damage to your credit score and potential legal action by the lender.

What is known about private student loan default?

Image Source: cloudfront.net

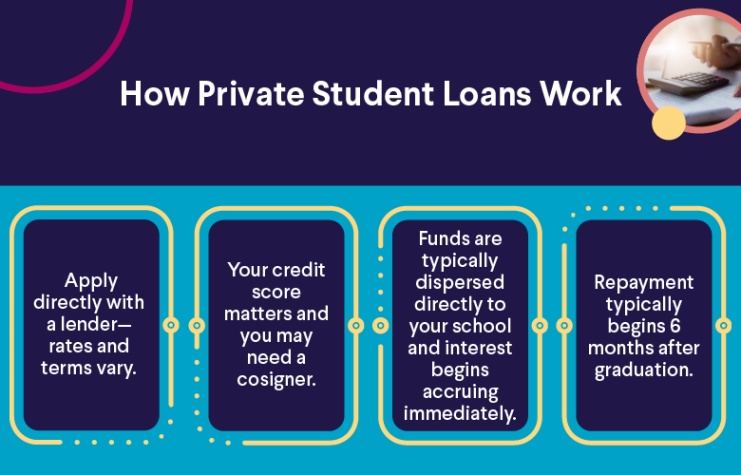

Private student loan default is a serious issue that can have long-lasting consequences for borrowers. When you default on a private student loan, it can damage your credit score, making it difficult to qualify for future loans or credit cards. In addition, the lender may pursue legal action against you to try to recoup the money you owe. It’s important to address a default on a private student loan as soon as possible to avoid these negative consequences.

What is the solution to getting private student loans out of default?

Image Source: mycreditcounselor.net

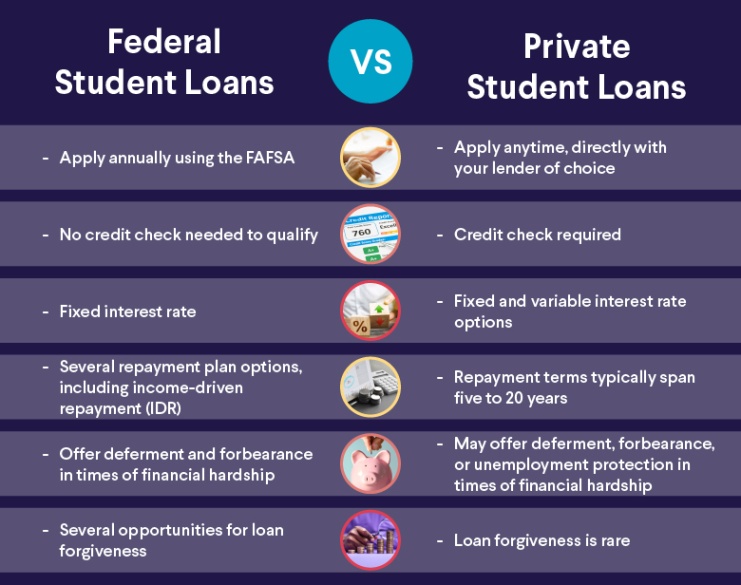

There are several steps you can take to get private student loans out of default. The first step is to contact your lender to discuss your options. They may be willing to work with you to come up with a repayment plan that fits your budget. You may also be able to negotiate a settlement with the lender to pay off the loan in full or in part. Another option is to consolidate your loans, which can help lower your monthly payments and make it easier to pay off the debt.

Information on getting private student loans out of default

Image Source: cloudfront.net

Getting private student loans out of default can be a challenging process, but it is possible with the right approach. It’s important to contact your lender as soon as possible to discuss your options and come up with a plan to get back on track with your payments. You may be able to negotiate a repayment plan or settlement with the lender, or consolidate your loans to make them more manageable. It’s important to take action quickly to avoid further damage to your credit score and potential legal action by the lender.

How to get private student loans out of default

When it comes to getting private student loans out of default, there are several steps you can take to improve your situation. The first step is to contact your lender and discuss your options. They may be willing to work with you to come up with a repayment plan that fits your budget. You may also be able to negotiate a settlement with the lender to pay off the loan in full or in part. Another option is to consolidate your loans, which can help lower your monthly payments and make it easier to pay off the debt. Taking action quickly is key to resolving a default on a private student loan.

Conclusion

Defaulting on a private student loan can have serious consequences, but there are steps you can take to get back on track with your payments. By contacting your lender and discussing your options, you may be able to negotiate a repayment plan or settlement that works for both parties. Consolidating your loans can also help make them more manageable. It’s important to take action quickly to avoid further damage to your credit score and potential legal action by the lender.

FAQs

1. Can I negotiate a settlement with my lender to pay off my private student loan?

Yes, it is possible to negotiate a settlement with your lender to pay off your private student loan. This can help you avoid default and get back on track with your payments.

2. How can consolidating my loans help me get out of default?

Consolidating your loans can help lower your monthly payments and make it easier to pay off your debt. This can be a good option for borrowers struggling to keep up with multiple loan payments.

3. What should I do if I can’t afford to make my monthly payments on my private student loan?

If you are struggling to make your monthly payments on your private student loan, it’s important to contact your lender as soon as possible to discuss your options. They may be willing to work with you to come up with a plan that fits your budget.

4. Will defaulting on a private student loan affect my credit score?

Yes, defaulting on a private student loan can have a negative impact on your credit score. It’s important to take action quickly to avoid further damage to your credit.

5. What are the consequences of defaulting on a private student loan?

The consequences of defaulting on a private student loan can include damage to your credit score, potential legal action by the lender, and difficulty qualifying for future loans or credit cards.

6. How long does it take to get private student loans out of default?

The time it takes to get private student loans out of default can vary depending on your individual situation. It’s important to take action quickly to resolve the default and avoid further consequences.

7. Is it possible to get private student loans out of default on my own?

While it is possible to get private student loans out of default on your own, it can be a challenging process. It’s often helpful to work with your lender or a financial advisor to come up with a plan to resolve the default.

how to get private student loans out of default