How to Get a Business Loan with Lendio

What do you mean by a business loan from Lendio?

A business loan from Lendio is a type of financing that helps small business owners access the capital they need to grow and expand their operations. Lendio is a marketplace that connects borrowers with a network of lenders, making it easier for business owners to find the right loan for their needs.

How can you get a business loan with Lendio?

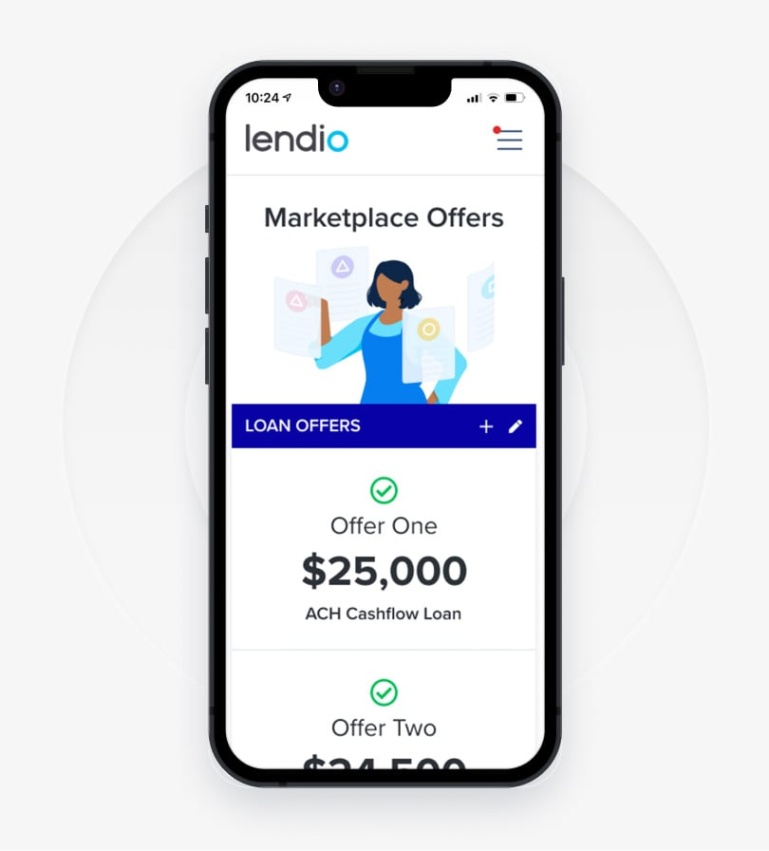

Image Source: lendio.com

Getting a business loan with Lendio is a simple and straightforward process. To begin, you’ll need to visit the Lendio website and fill out an online application. The application will ask for information about your business, including your revenue, credit score, and how you plan to use the funds.

Image Source: lendio.com

Once you’ve submitted your application, Lendio will match you with lenders who are interested in working with businesses like yours. You’ll receive offers from multiple lenders, allowing you to compare rates and terms before choosing the loan that best fits your needs.

What is known about Lendio?

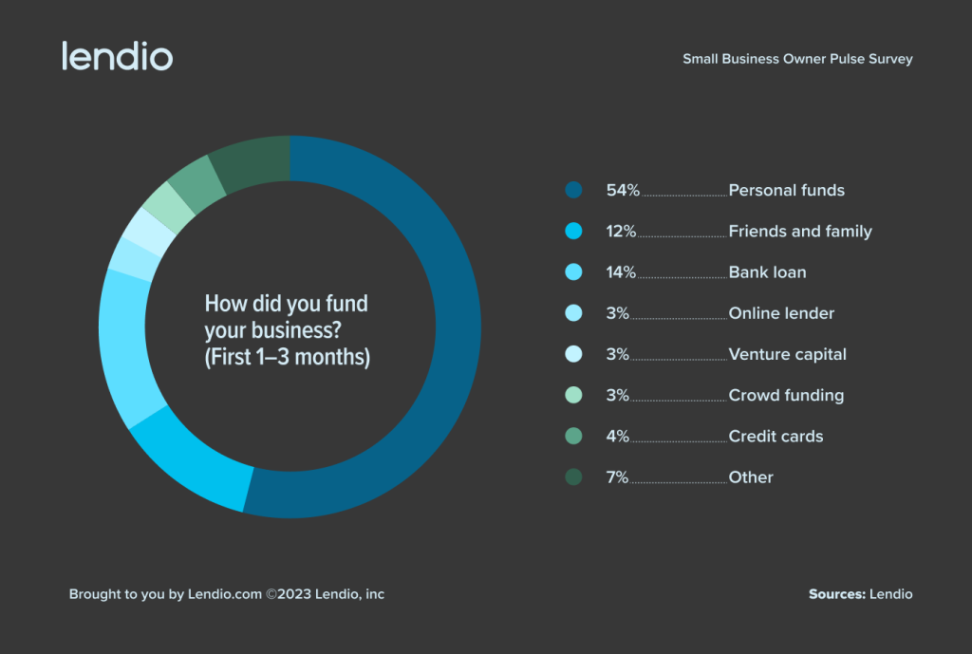

Image Source: lendio.com

Lendio is a leading online marketplace for small business loans, with a reputation for providing fast and reliable funding to business owners across the country. The company has a network of over 75 lenders, making it easy for borrowers to find the right loan for their unique circumstances.

Lendio offers a wide range of loan options, including term loans, lines of credit, equipment financing, and more. The company is known for its excellent customer service and commitment to helping small businesses succeed.

What is the solution for getting a business loan with Lendio?

If you’re in need of financing for your small business, Lendio can help. By using their online marketplace, you can quickly and easily compare loan offers from multiple lenders, ensuring that you get the best rates and terms available.

With Lendio, you can access the capital you need to grow your business, whether you’re looking to expand your operations, purchase equipment, or cover unexpected expenses. Their streamlined application process and personalized loan matching make it easy to find the right financing solution for your business.

Information about Lendio

Lendio was founded in 2011 with the mission of helping small business owners access the funding they need to succeed. Since then, the company has facilitated over $2 billion in loans to thousands of businesses across the United States.

Lendio works with a wide range of lenders, from traditional banks to online lenders, to ensure that borrowers have access to the best loan options available. The company’s dedication to customer service and commitment to transparency have earned them a reputation as a trusted partner for small business owners.

How to Get a Business Loan with Lendio

Getting a business loan with Lendio is a straightforward process that can be completed entirely online. To begin, visit the Lendio website and fill out an application form. The form will ask for information about your business, including your revenue, credit score, and how you plan to use the funds.

Once you’ve submitted your application, Lendio will review your information and match you with lenders who are interested in working with businesses like yours. You’ll receive multiple loan offers, allowing you to compare rates and terms before choosing the loan that best fits your needs.

Conclusion

Getting a business loan with Lendio is a quick and easy way to access the capital you need to grow your business. With their online marketplace and network of lenders, you can compare loan offers and find the right financing solution for your unique circumstances. Don’t let a lack of funding hold your business back – explore your options with Lendio today.

FAQs

1. Can I get a business loan with bad credit?

Yes, Lendio works with lenders who offer loans to business owners with less-than-perfect credit. However, the terms of the loan may vary depending on your credit score.

2. How long does it take to get approved for a business loan with Lendio?

The approval process can vary depending on the lender and the loan amount. In general, you can expect to receive a decision within a few days of submitting your application.

3. What types of loans does Lendio offer?

Lendio offers a wide range of loan options, including term loans, lines of credit, equipment financing, and more. Their goal is to help small business owners find the right financing solution for their needs.

4. Are there any fees associated with getting a business loan through Lendio?

Lendio does not charge any fees to borrowers for using their online marketplace. However, individual lenders may have their own fees and charges associated with the loan.

5. Can I use a business loan from Lendio for any purpose?

Yes, you can use the funds from a Lendio business loan for any legitimate business purpose, such as expanding your operations, purchasing equipment, or covering operating expenses.

6. What is the minimum credit score required to qualify for a business loan with Lendio?

There is no minimum credit score required to apply for a business loan with Lendio. However, your credit score may impact the terms and rates of the loan you receive.

7. Is Lendio a direct lender?

No, Lendio is not a direct lender. Instead, they are an online marketplace that connects borrowers with a network of lenders who offer small business loans.

how to get a business loan lendio