Unlock Your Dream Home

Are you ready to take the first step towards securing your dream home? With the help of a VA loan, you can make your homeownership dreams a reality. VA loans are a great option for military members, veterans, and their families who are looking to purchase a home with little to no down payment.

Image Source: benefits.va.gov

Securing a VA loan online is easier than ever, thanks to the convenience of the internet. By following a few simple steps, you can be well on your way to unlocking the door to your dream home.

The first step in the process is to determine if you are eligible for a VA loan. If you are an active-duty service member, a veteran, or a surviving spouse of a service member, you may qualify for this special loan program. Once you have confirmed your eligibility, the next step is to gather the necessary documents to apply for a VA loan online.

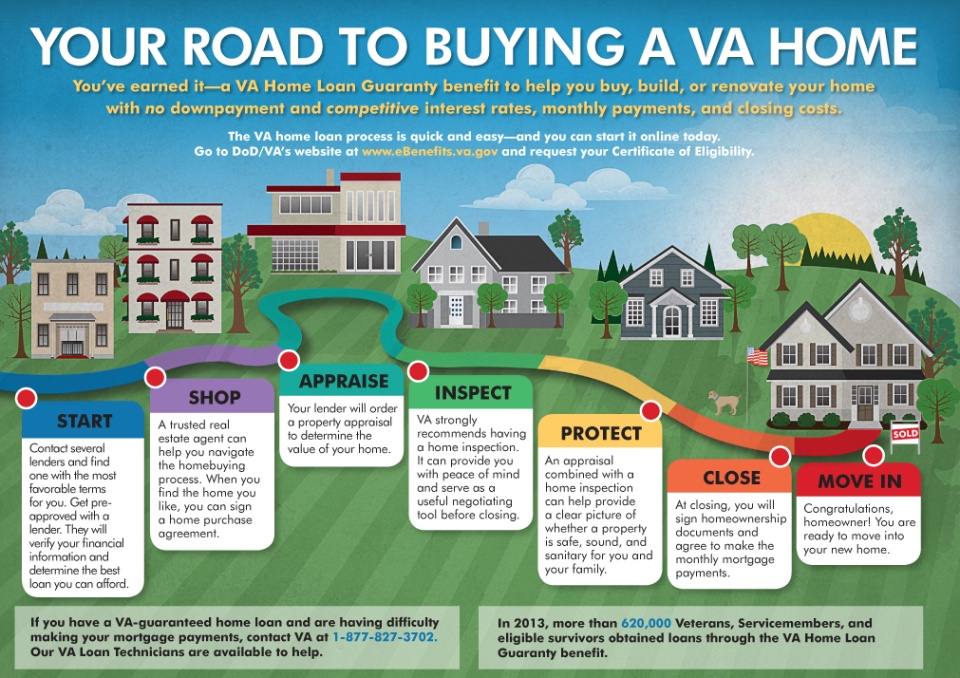

Image Source: highmarkfcu.com

You will need to provide your Certificate of Eligibility, which can be obtained through the Department of Veterans Affairs. This document verifies your military service and confirms your eligibility for a VA loan. You will also need to gather your financial documents, such as pay stubs, W-2 forms, and bank statements, to demonstrate your income and financial stability to potential lenders.

With your documents in hand, it’s time to start the online application process. There are many lenders who offer VA loans online, so be sure to shop around and compare rates and terms to find the best option for you. Once you have chosen a lender, you can begin the application process by filling out the necessary forms and providing the required documentation.

Image Source: veteransunited.com

The online application process for a VA loan is typically quick and easy, allowing you to complete the entire process from the comfort of your own home. You can upload your documents securely, communicate with your lender via email or phone, and track the progress of your application online. This convenient process saves you time and hassle, making it easier than ever to secure your dream home.

After you have submitted your application and provided all necessary documentation, your lender will review your information and determine if you qualify for a VA loan. If you are approved, you will receive a loan commitment letter outlining the terms of your loan, including the interest rate, loan amount, and repayment schedule.

Image Source: news.va.gov

With your loan commitment in hand, you can start shopping for your dream home with confidence. You can work with a Real Estate agent to find the perfect property that meets your needs and budget. Your lender will work with you and the seller to finalize the purchase agreement and schedule a closing date.

On the day of closing, you will sign the necessary paperwork and officially become a homeowner. With the help of a VA loan, you can unlock the door to your dream home and secure your future today. Don’t let the fear of the homebuying process hold you back – with online VA loans, the path to homeownership has never been easier. Start your journey towards securing your dream home today!

Easy Steps to VA Loan Success

Image Source: benefits.va.gov

Are you a veteran or an active-duty service member looking to secure your dream Home? Look no further than a VA loan! VA loans offer a variety of benefits, such as no down payment, lower interest rates, and no private mortgage insurance requirements. Securing a VA loan online may seem like a daunting task, but with these easy steps, you’ll be well on your way to homeownership in no time.

Step 1: Determine Your Eligibility

The first step to VA loan success is determining your eligibility. To qualify for a VA loan, you must meet certain service requirements, such as serving for a minimum amount of time during wartime or peacetime. Additionally, surviving spouses of veterans may also be eligible for VA loans. Once you determine your eligibility, you can move on to the next step.

Step 2: Get Pre-Approved

Getting pre-approved for a VA loan is a crucial step in the homebuying process. By getting pre-approved, you’ll know exactly how much you can afford to spend on a home, which will help you narrow down your search. To get pre-approved, you’ll need to provide documentation of your income, employment history, and credit score. Once you have all of the necessary documents, you can apply for pre-approval online through a VA-approved lender.

Step 3: Find a Real Estate Agent

Finding a real estate agent who is familiar with VA loans is essential to your success. A knowledgeable real estate agent will help you navigate the homebuying process, negotiate on your behalf, and ensure that you find a home that meets your needs and budget. Additionally, a real estate agent can help you understand any special requirements or considerations when using a VA loan to purchase a home.

Step 4: Start House Hunting

With your pre-approval in hand and a real estate agent by your side, it’s time to start house hunting! Use online resources, such as real estate websites and apps, to search for homes in your desired location and price range. Make a list of must-have features and amenities, and schedule appointments to view potential homes in person. Remember, patience is key in the homebuying process, so take your time to find the perfect home for you and your family.

Step 5: Make an Offer and Close the Deal

Once you find the home of your dreams, it’s time to make an offer and close the deal. Your real estate agent will help you negotiate with the seller, submit an offer, and navigate the closing process. Be prepared to provide documentation of your VA loan approval, as well as any additional paperwork required by the lender. Once all of the necessary documents are in order, you’ll sign the final paperwork, get the keys to your new home, and officially become a homeowner!

In conclusion, securing a VA loan online and purchasing your dream home is a rewarding and exciting process. By following these easy steps to VA loan success, you can achieve your goal of homeownership and secure your future today. So don’t wait any longer – start the journey to your dream home with a VA loan today!

Secure Your Future Today!

Are you ready to take the next step towards securing your dream Home? With the help of a VA loan, you can make your homeownership dreams a reality. By following a few easy steps, you can secure your future today and start the journey towards owning your own home.

First and foremost, it’s important to understand the benefits of a VA loan. As a veteran or active-duty service member, you have access to this special loan program that offers competitive interest rates and no down payment requirement. This means that you can purchase a home with little to no money down, making it easier than ever to become a homeowner.

To secure your future with a VA loan, the first step is to determine your eligibility. You can do this by obtaining a Certificate of Eligibility (COE) from the Department of Veterans Affairs. This document confirms your eligibility for a VA loan and is required by lenders to approve your loan application.

Once you have your COE in hand, the next step is to find a lender who specializes in VA loans. These lenders have experience working with veterans and understand the ins and outs of the VA loan program. They can guide you through the application process and help you secure the best loan terms for your unique situation.

After selecting a lender, the next step is to gather all the necessary documents for your loan application. This typically includes proof of income, employment history, and credit history. Your lender will review these documents to determine your eligibility for a VA loan and to calculate the maximum loan amount you qualify for.

With your documents in hand, you can now complete the loan application process. This may involve submitting your documents online or meeting with a loan officer in person. Your lender will review your application and let you know if you are approved for a VA loan.

Once your loan is approved, the final step is to secure your dream home. With a VA loan in hand, you can start shopping for homes within your budget and making offers on properties that meet your needs. Your lender will work with you to finalize the loan details and schedule a closing date.

By following these easy steps, you can secure your future today and move one step closer to owning your dream home. With the help of a VA loan, becoming a homeowner is easier than ever for veterans and active-duty service members. Don’t wait any longer – start the process today and secure your future with a VA loan.

Online Path to Homeownership

Are you ready to take the first step towards securing your dream home? Look no further than the online path to homeownership! With the convenience and accessibility of the internet, you can now easily score a VA loan online and make your dream home a reality.

Gone are the days of long, tedious paperwork and countless trips to the bank. With just a few clicks on your computer or mobile device, you can start the process of securing a VA loan and ultimately, your dream home.

The online path to homeownership offers a seamless and efficient way to navigate the often daunting process of buying a home. From researching different loan options to filling out applications, everything can be done conveniently from the comfort of your own home.

By utilizing online resources, you can compare different lenders, rates, and loan options to ensure you are getting the best deal possible. This allows you to make informed decisions and choose the loan that best fits your financial situation and homeownership goals.

One of the biggest advantages of taking the online path to homeownership is the speed and efficiency at which you can secure a VA loan. With traditional methods, the process of securing a loan can often take weeks or even months. However, with online tools and resources, you can significantly shorten this timeline and expedite the process.

Furthermore, the online path to homeownership provides access to valuable information and resources that can help guide you through the entire homebuying process. From understanding your credit score to determining how much you can afford to spend on a home, these resources can help you make informed decisions every step of the way.

In addition to the convenience and efficiency of the online path to homeownership, there are also cost-saving benefits to consider. By using online resources to secure a VA loan, you can potentially save money on application fees, closing costs, and other expenses associated with the homebuying process.

Overall, the online path to homeownership offers a modern and user-friendly approach to securing a VA loan and buying your dream home. With just a few clicks, you can access valuable information, compare loan options, and take the necessary steps towards homeownership. So why wait? Start your journey towards securing your dream home today, all from the comfort of your own home.

Online Path to Homeownership

Are you ready to take the next step towards securing your dream home? With the ease and convenience of the online path to homeownership, you can make your dreams a reality in just a few simple steps. By utilizing the power of the internet, you can easily navigate the process of obtaining a VA loan and purchasing the home of your dreams.

The first step on your online path to homeownership is to research and compare different lenders who offer VA loans. By taking the time to explore your options and find a lender that fits your needs, you can ensure that you are getting the best deal possible. Many lenders offer online applications, making it easy to apply for a VA loan from the comfort of your own home.

Once you have chosen a lender and completed the application process, the next step is to gather all necessary documents and information to support your loan application. This may include proof of income, tax returns, bank statements, and other financial documents. By organizing and submitting these documents online, you can expedite the loan approval process and get one step closer to homeownership.

After your loan application has been approved, the next step on your online path to homeownership is to start house hunting. There are many online tools and resources available to help you search for homes that meet your criteria and budget. Websites like Zillow, Realtor.com, and Trulia allow you to search for homes based on location, price, size, and other factors. You can also use these websites to schedule virtual tours and view photos of potential properties.

Once you have found the perfect home, the next step is to make an offer and negotiate the terms of the sale. Many Real Estate agents and sellers prefer to communicate online, making it easy to submit offers and counteroffers via email or online messaging platforms. By staying organized and responsive throughout the negotiation process, you can increase your chances of securing the home of your dreams.

Once your offer has been accepted and the sale is finalized, the final step on your online path to homeownership is to close on the property. Many lenders offer online closing services, allowing you to sign documents electronically and complete the transaction from the comfort of your own home. By taking advantage of these online services, you can streamline the closing process and move into your new home sooner.

In conclusion, the online path to homeownership offers a convenient and efficient way to secure your dream home. By researching lenders, organizing your documents, house hunting online, negotiating offers, and closing on the property electronically, you can navigate the homebuying process with ease. Take the first step towards homeownership today and start your online journey to securing the home of your dreams.

Online Path to Homeownership

Are you ready to take the exciting journey towards homeownership? With the advancement of technology, securing a VA loan online has never been easier. In today’s fast-paced world, convenience is key, and the online path to homeownership is the perfect solution for busy individuals looking to achieve their dream of owning a home.

Gone are the days of long waits at the bank and mountains of paperwork. With just a few easy steps, you can be well on your way to securing your dream home with a VA loan. The online process is simple, efficient, and can be completed from the comfort of your own home. So, let’s dive into the steps to secure your dream home through the online path to homeownership.

First and foremost, you will need to gather all necessary documents to apply for a VA loan online. This includes your proof of income, employment history, credit score, and any additional documents required by your lender. Having these documents readily available will streamline the application process and help you secure your loan faster.

Next, you will need to find a reputable online lender that specializes in VA loans. Research different lenders, read reviews, and compare interest rates to find the best fit for your financial situation. Once you have chosen a lender, you can begin the online application process.

The online application for a VA loan is typically straightforward and user-friendly. You will be asked to provide personal information, financial details, and submit your supporting documents. Be sure to double-check all information before submitting your application to avoid any delays in the approval process.

After submitting your application, the lender will review your information and determine your eligibility for a VA loan. If approved, you will receive a pre-approval letter outlining the terms of your loan, including the loan amount, interest rate, and repayment terms. This pre-approval letter is essential when shopping for your dream home, as it shows sellers that you are a serious buyer with financing in place.

With your pre-approval letter in hand, you can start the exciting process of house hunting. Use online Real Estate websites and apps to search for homes that meet your criteria, such as location, size, and price range. Once you find the perfect home, work with your real estate agent to submit an offer and negotiate the terms of the sale.

Once your offer is accepted, you will work with your lender to finalize the loan paperwork and schedule a closing date. The online path to homeownership streamlines the closing process, allowing you to sign documents electronically and complete the transaction efficiently.

On the day of closing, you will sign the final paperwork, pay any closing costs, and receive the keys to your new home. Congratulations! You are now a proud homeowner thanks to the online path to homeownership and your VA loan.

In conclusion, securing a VA loan online is a simple and efficient way to achieve your dream of homeownership. By following the easy steps outlined above, you can navigate the online process with confidence and secure your dream home in no time. Say goodbye to long waits and mountains of paperwork, and say hello to the convenience and ease of the online path to homeownership. Happy house hunting!

Online Path to Homeownership

Are you ready to take the next step towards owning your dream home? With the advancement of technology, the process of securing a VA loan online has never been easier. Gone are the days of filling out endless paperwork and waiting weeks for approval. Now, you can secure your dream home with just a few clicks of a button.

The online path to homeownership begins with doing your research. Before diving into the world of VA loans, take some time to educate yourself on the process. There are countless resources available online that can help you understand the ins and outs of securing a VA loan. From eligibility requirements to the application process, being informed is key to success.

Once you feel confident in your understanding of VA loans, it’s time to start the application process. Many lenders now offer online applications that can be completed from the comfort of your own home. Simply fill out the required information, submit any necessary documents, and wait for approval. The online application process is quick and convenient, allowing you to move one step closer to owning your dream home.

After your application has been submitted, the next step is to wait for approval. With the online path to homeownership, approval times are often much quicker than traditional methods. Lenders are able to review your application and make a decision in a fraction of the time it used to take. This means you can start house hunting sooner and secure your dream home faster.

Once you have been approved for a VA loan, it’s time to start shopping for your dream home. With the convenience of online listings and virtual tours, finding the perfect home has never been easier. You can browse through countless options, compare prices, and even schedule viewings all from the comfort of your own home. The online path to homeownership puts the power in your hands, allowing you to find a home that meets all of your needs and desires.

After you have found the perfect home, the final step is to close the deal. With the online path to homeownership, closing on a home has never been simpler. Many lenders now offer e-closings, allowing you to sign all necessary documents electronically. This means no more scheduling appointments or rushing to meet deadlines. You can finalize the purchase of your dream home from anywhere in the world, making the process stress-free and efficient.

In conclusion, the online path to homeownership is a game-changer for those looking to secure a VA loan. With the convenience of online applications, quick approval times, and virtual house hunting, the process of owning your dream home has never been easier. So why wait? Start your journey towards homeownership today and make your dream home a reality.

Online Path to Homeownership

Are you ready to make your dream of homeownership a reality? With the convenience and accessibility of the internet, securing a VA loan online has never been easier. Gone are the days of lengthy paperwork and endless waiting periods – now you can take control of your home buying journey with just a few clicks.

The online path to homeownership is a game-changer for those looking to purchase a home using a VA loan. With the help of technology, you can streamline the entire process and eliminate the hassle of traditional loan applications. Here are some easy steps to help you secure your dream home online:

1. Research and Compare Lenders: The first step on your online path to homeownership is to research and compare different lenders who offer VA loans. Take the time to read reviews, compare interest rates, and look for lenders who have experience working with VA loans. By doing your homework, you can find a lender who will best meet your needs and help you achieve your homeownership goals.

2. Prequalify for a Loan: Once you have chosen a lender, the next step is to prequalify for a VA loan online. This process is quick and easy, and will give you a better understanding of how much you can afford to borrow. By prequalifying, you can also show sellers that you are a serious buyer and increase your chances of securing your dream home.

3. Gather Necessary Documents: To expedite the online loan process, gather all necessary documents before applying for a VA loan. This may include proof of income, bank statements, tax returns, and proof of military service. By having these documents ready, you can avoid delays and move one step closer to homeownership.

4. Complete the Online Application: With your documents in hand, it’s time to complete the online application for your VA loan. Most lenders have user-friendly online portals where you can input your information and upload your documents. The online application process is quick and convenient, allowing you to apply for a loan from the comfort of your own home.

5. Stay in Communication: Throughout the online loan process, it’s important to stay in communication with your lender. Be responsive to any requests for additional information or documents, and ask questions if you need clarification on any part of the process. By maintaining open lines of communication, you can ensure a smooth and efficient loan approval process.

6. Close on Your Dream Home: Once your online VA loan is approved, it’s time to close on your dream home. This exciting step marks the culmination of your online path to homeownership and signals the beginning of a new chapter in your life. Celebrate this milestone and look forward to making memories in your new home.

In conclusion, the online path to homeownership is a convenient and efficient way to secure a VA loan and purchase your dream home. By following these easy steps and utilizing the power of technology, you can make your dream of homeownership a reality. Say goodbye to traditional loan applications and embrace the ease and accessibility of securing a VA loan online. Start your journey today and take the first step towards owning the home of your dreams.

Online Path to Homeownership

Are you ready to take the next step towards owning your dream home? With the convenience of the internet, securing a VA loan online has never been easier. By following a few simple steps, you can be well on your way to becoming a homeowner.

The first step on the online path to homeownership is to research and compare different lenders. By doing some research online, you can find reputable lenders who specialize in VA loans. Look for lenders that have positive reviews and a track record of helping veterans secure home loans.

Once you have found a few lenders that you are interested in, it’s time to start the application process. Most lenders have online applications that you can fill out from the comfort of your own home. Be sure to have all of your financial information ready, including pay stubs, bank statements, and tax returns.

After submitting your application, the lender will review your information and determine if you pre-qualify for a VA loan. If you are pre-qualified, the lender will provide you with a pre-approval letter, which will outline how much you can borrow and at what interest rate.

With your pre-approval letter in hand, you can start house hunting. Use online resources such as Real Estate websites to search for homes in your desired area. Once you find a home that you love, it’s time to make an offer.

Your lender will work with you to finalize the loan terms and schedule a home appraisal. Once the home passes the appraisal and all necessary paperwork is completed, you will be ready to close on your new home.

Securing a VA loan online is a convenient and efficient way to become a homeowner. By following these easy steps, you can turn your dream of owning a home into a reality. Start your online path to homeownership today and take the first step towards securing your dream home.

Online Path to Homeownership

Are you ready to embark on the exciting journey of homeownership? With the convenience and accessibility of the internet, securing your dream home has never been easier. By taking advantage of online resources and tools, you can streamline the process of obtaining a VA loan and make your homeownership dreams a reality.

One of the first steps on your online path to homeownership is to research and educate yourself about VA loans. As a current or former member of the military, you may be eligible for a VA loan, which offers numerous benefits such as no down payment and lower interest rates. By understanding the requirements and benefits of a VA loan, you can better navigate the homebuying process and make informed decisions about your future home.

Once you have familiarized yourself with VA loans, the next step is to find a reputable online lender who specializes in VA loans. By working with an experienced lender who understands the intricacies of VA loans, you can ensure a smooth and efficient loan application process. Many online lenders offer user-friendly websites and online applications, making it easy to apply for a VA loan from the comfort of your own home.

After selecting a lender, it’s time to gather the necessary documents and information to complete your VA loan application online. This may include your proof of military service, income verification, credit history, and other financial documents. By organizing your documents ahead of time and submitting them online, you can expedite the loan approval process and move one step closer to securing your dream home.

In addition to submitting your documents online, you can also use online tools and calculators to estimate your monthly mortgage payments and determine how much you can afford to borrow. By entering your financial information into these tools, you can get a clear picture of your budget and make informed decisions about the type of home you can afford.

Once your loan application has been submitted and approved, it’s time to start house hunting online. With the vast array of Real Estate websites and online listings available, you can easily search for homes that meet your criteria and preferences. From the comfort of your own home, you can view photos, virtual tours, and property details to narrow down your options and find the perfect home for you and your family.

As you browse through online listings and attend virtual open houses, don’t forget to consult with a real estate agent who specializes in VA loans. A knowledgeable agent can guide you through the homebuying process, negotiate on your behalf, and help you find a home that meets your needs and budget. By working with a real estate agent who understands VA loans, you can ensure a seamless and stress-free homebuying experience.

Once you have found the perfect home and your offer has been accepted, it’s time to close on your VA loan and officially become a homeowner. Many lenders offer online closing options, allowing you to sign documents electronically and complete the closing process from anywhere with an internet connection. By taking advantage of online closing services, you can save time and eliminate the need for in-person meetings at a title company or attorney’s office.

In conclusion, the online path to homeownership offers a convenient and efficient way to secure your dream home with a VA loan. By researching, applying, and house hunting online, you can streamline the homebuying process and make your dream of homeownership a reality. So why wait? Start exploring the online resources available to you and take the first step towards owning your own piece of the American dream.

Unlock Your Dream Home with a VA Loan!

Are you dreaming of owning your own home but struggling to find a way to make it happen? Look no further than a VA loan! With a VA loan, you can unlock the door to your dream home and start building the life you’ve always wanted.

VA loans are a fantastic option for veterans, active-duty service members, and their families who are looking to purchase a home. These loans are backed by the U.S. Department of Veterans Affairs, making them a secure and reliable choice for those who have served our country.

One of the biggest advantages of a VA loan is that they often require no down payment, making homeownership much more accessible for those who may not have a large savings account. This can be a game-changer for many people who are struggling to come up with the funds for a traditional mortgage.

In addition to the lack of a down payment requirement, VA loans also have competitive interest rates, making them an affordable option for those looking to buy a home. With lower monthly payments, you can enjoy your new home without breaking the bank.

Another great benefit of a VA loan is that they do not require private mortgage insurance, saving you even more money in the long run. This can make a huge difference in your monthly expenses and allow you to put that money towards other important things, like furnishing your new home or saving for the future.

Applying for a VA loan is easier than you may think. Thanks to modern technology, you can now apply for a VA loan online, making the process faster and more convenient than ever before. You can fill out an application, submit required documents, and even get pre-approved, all from the comfort of your own home.

To get started on your homeownership journey with a VA loan, all you need to do is gather some basic information about your military service, employment history, and finances. Once you have that information ready, you can begin the application process and be on your way to owning your dream home in no time.

With a VA loan, you can turn your dream home into a reality today. Say goodbye to renting and hello to homeownership with a loan that is designed specifically for those who have served our country. Don’t let the fear of a down payment or high interest rates hold you back any longer – take advantage of the benefits of a VA loan and start building the life you’ve always wanted.

So what are you waiting for? Unlock your dream home with a VA loan today and take the first step towards a brighter future. Get started on your journey to homeownership and make your dreams come true with the help of a VA loan. Your dream home is closer than you think – all you have to do is reach out and grab it.

Applying for a VA Loan Made Simple

Are you dreaming of owning your own Home but unsure of how to make it a reality? Look no further than applying for a VA loan, a simple and efficient way for veterans and active-duty service members to secure financing for their dream home. Whether you are a first-time homebuyer or looking to refinance your current home, a VA loan can make the process easier and more affordable.

The first step in applying for a VA loan is to determine your eligibility. To qualify for a VA loan, you must meet certain requirements set by the Department of Veterans Affairs. These requirements include having served a certain number of days of active duty, being a current or former member of the military, and meeting specific credit and income criteria. Once you have confirmed your eligibility, the next step is to gather the necessary documentation to support your loan application.

One of the key benefits of a VA loan is that it requires no down payment, making it an attractive option for those who may not have significant savings. In addition to not requiring a down payment, VA loans also do not require private mortgage insurance, which can save you money on your monthly mortgage payments. This can make a significant impact on your overall financial situation and make homeownership more attainable.

To begin the application process for a VA loan, you can start by contacting a VA-approved lender. These lenders are familiar with the requirements of VA loans and can guide you through the application process. They will work with you to gather the necessary documentation, such as your Certificate of Eligibility, proof of income, and credit history. Once you have submitted all of the required documentation, the lender will review your application and determine if you qualify for a VA loan.

One of the advantages of applying for a VA loan online is the convenience and ease of the process. Many lenders offer online application portals that allow you to submit your information and documentation electronically, saving you time and hassle. You can also track the progress of your application and communicate with your lender through the online portal, making the process more streamlined and efficient.

Another benefit of applying for a VA loan online is the speed at which you can receive a decision on your application. Traditional mortgage applications can take weeks to process, but with a VA loan, you can often receive a decision in a matter of days. This can help you move forward with purchasing your dream home more quickly and with less stress.

In addition to the convenience of applying for a VA loan online, many lenders also offer resources and tools to help you understand the process and make informed decisions. These resources may include mortgage calculators, educational materials, and personalized guidance from experienced loan officers. By taking advantage of these resources, you can feel confident in your decision to apply for a VA loan and take the next step toward homeownership.

In conclusion, applying for a VA loan is a simple and efficient way to secure financing for your dream home. By understanding the requirements, gathering the necessary documentation, and working with a VA-approved lender, you can navigate the application process with ease. With the convenience of applying online and the support of experienced professionals, you can make your dream of homeownership a reality. So don’t wait any longer – get started on your journey to homeownership today!

Get Started on Your Homeownership Journey

Are you ready to take the leap into homeownership? One of the first steps you can take towards achieving this goal is to apply for a VA loan online. With the help of this government-backed loan program, you can finally turn your dream of owning a home into a reality.

Applying for a VA loan online is a simple and convenient process that can help you secure the financing you need to purchase the home of your dreams. Whether you are a first-time homebuyer or looking to refinance your current mortgage, a VA loan can offer you many benefits that make the homebuying process easier and more affordable.

One of the main advantages of a VA loan is that it allows for 100% financing, meaning you can purchase a home with no down payment. This can be a huge help for those who may not have the funds saved up for a traditional down payment. Additionally, VA loans often come with lower interest rates compared to conventional loans, saving you money in the long run.

To get started on your homeownership journey with a VA loan, the first step is to gather all the necessary documents and information you will need to complete the application process online. This may include proof of income, employment history, credit score, and any additional financial information.

Once you have all your documents in order, you can begin the application process by filling out a simple online form. This form will ask for basic information about yourself, your income, and the home you are looking to purchase. Be sure to provide accurate and up-to-date information to ensure a smooth application process.

After you have submitted your application, a VA loan specialist will review your information and determine if you qualify for a VA loan. If you meet the eligibility requirements, you will be pre-approved for a loan amount that you can use to start shopping for your dream home.

With your pre-approval in hand, you can begin working with a Real Estate agent to find the perfect home for you and your family. Your real estate agent can help you navigate the homebuying process and negotiate the best deal for your new home.

Once you have found the perfect home, your VA loan specialist will work with you to finalize the loan details and secure the financing you need to purchase the property. They will help you understand the terms of the loan and ensure that you are comfortable with the monthly payments and overall cost of the loan.

After closing on your new home, you can finally move in and begin enjoying the benefits of homeownership. With a VA loan, you can rest easy knowing that you have secured a loan with favorable terms and affordable payments that fit your budget.

In conclusion, applying for a VA loan online is a great way to get started on your homeownership journey. With the help of this government-backed loan program, you can turn your dream of owning a home into a reality. So don’t wait any longer, start your application today and take the first step towards achieving your goal of homeownership.

Turn Your Dream Home into Reality Today!

Are you tired of renting and ready to settle into your own place? Do you dream of a home that is truly yours, where you can paint the walls any color you want and make renovations to your heart’s content? If so, it sounds like you’re ready to turn your dream home into a reality – and we’re here to help you do just that!

Applying for a VA loan is a simple and stress-free way to finance your dream home. Whether you’re a first-time homebuyer or a seasoned homeowner looking to upgrade, a VA loan can make the process easier and more affordable. And the best part? You can apply for a VA loan online, right from the comfort of your own home.

Gone are the days of waiting in line at the bank or scheduling appointments with loan officers. With just a few clicks and some basic information, you can be on your way to homeownership in no time. So, let’s dive into the easy steps you can take to apply for a VA loan and turn your dream home into a reality today!

The first step in the process is to gather all the necessary documents. This includes proof of income, bank statements, tax returns, and any other financial information that may be requested by the lender. Having these documents ready to go will expedite the application process and make things run smoothly.

Next, you’ll want to research different lenders and find one that you feel comfortable working with. Look for a lender that specializes in VA loans and has a good reputation for customer service. Once you’ve found the right lender, it’s time to start the online application process.

When filling out the application, be sure to provide accurate and honest information. This will help the lender assess your financial situation and determine how much you qualify for. Remember, the goal is to get you into your dream home, so being upfront and transparent is key.

After submitting your application, the lender will review your information and let you know if you’ve been approved for a VA loan. If you are approved, congratulations! You’re one step closer to turning your dream home into a reality. The lender will work with you to finalize the details and set a closing date.

Once everything is in order, you’ll sign the necessary paperwork and officially become a homeowner. It’s an exciting and rewarding process, and one that will make all the hard work worth it. From picking out paint colors to arranging furniture, you’ll finally have a place to call your own.

And the best part? You’ll be building equity in your home and investing in your future. Instead of throwing money away on rent, you’ll be investing in an asset that will appreciate over time. It’s a smart financial move that will benefit you and your family for years to come.

So, what are you waiting for? It’s time to turn your dream home into a reality today with a VA loan. By following these easy steps and applying online, you’ll be well on your way to homeownership. Say goodbye to renting and hello to your own place – it’s a decision you won’t regret.

how to apply for a va home loan online