Where Can I Consolidate My Private Student Loans

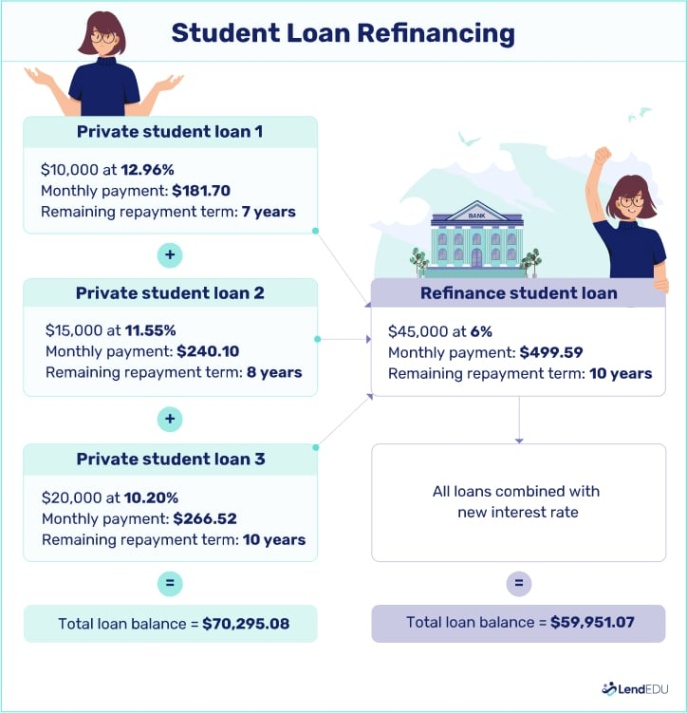

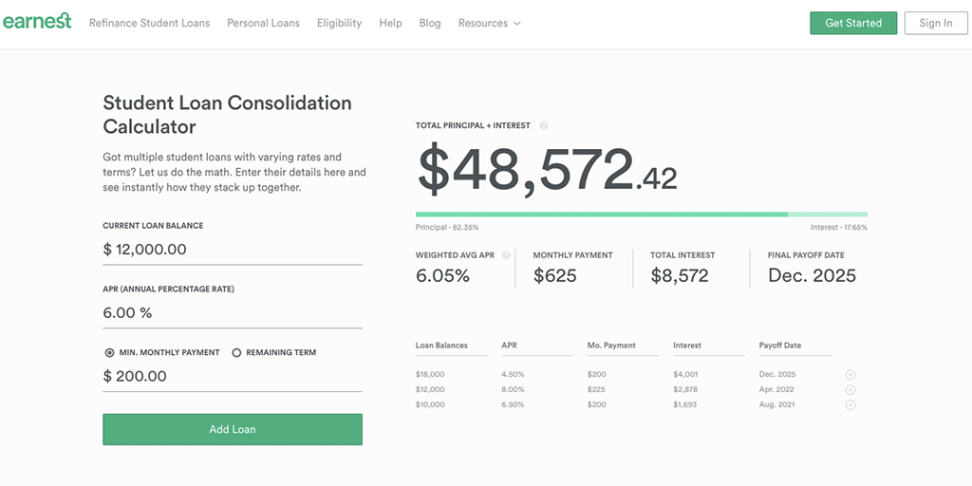

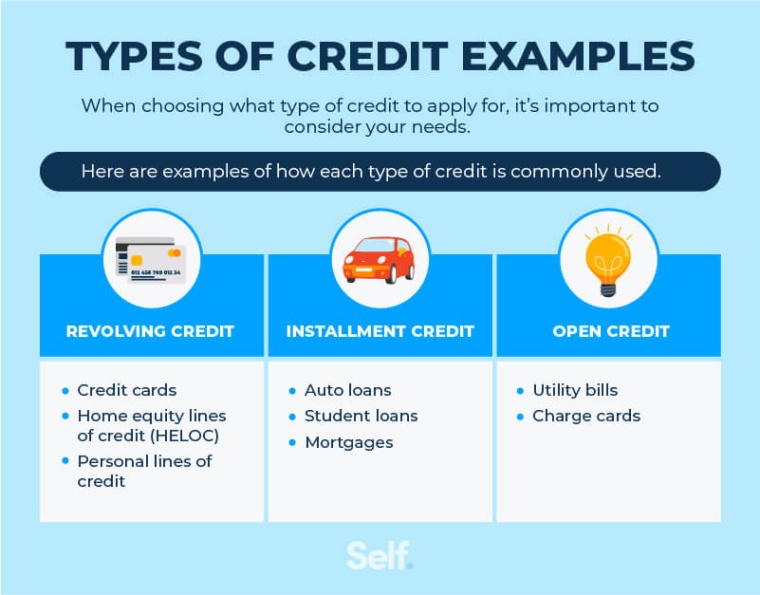

Where Can I Consolidate My Private Student Loans? What do you mean by consolidating private student loans? Consolidating private student loans involves combining multiple loans into one new loan, typically with a lower interest rate and a longer repayment term. This can make it easier to manage your debt and potentially save you money on … Read more