Can I Settle a Student Loan Debt?

What do you mean by settling a student loan debt?

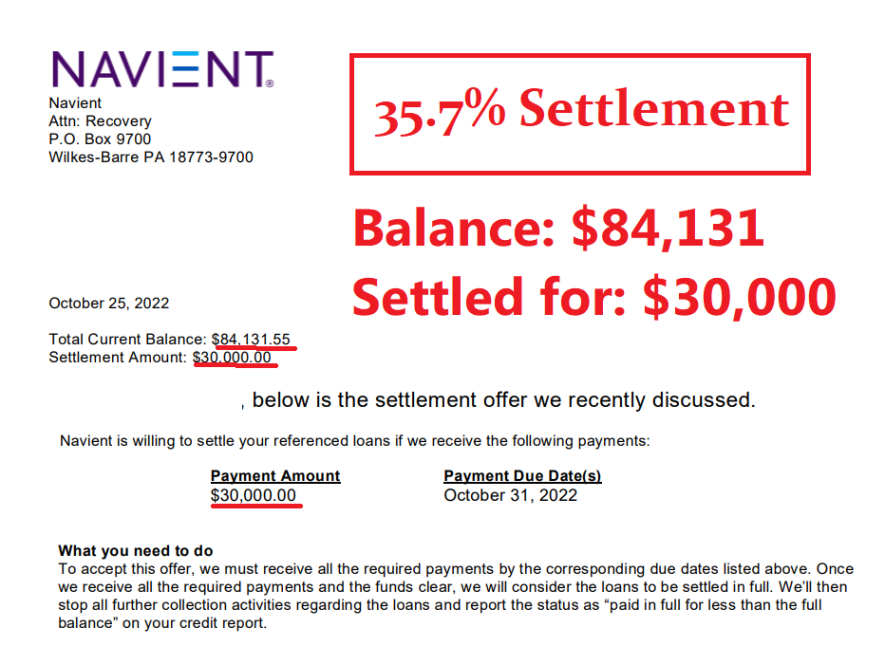

Settling a student loan debt means negotiating with your lender to pay a lump sum amount that is less than the total amount you owe. This can be a viable option for borrowers who are struggling to make their regular monthly payments and want to avoid defaulting on their loans.

How can I settle a student loan debt?

Image Source: forbes.com

There are a few ways you can go about settling your student loan debt. One option is to contact your lender directly and explain your financial situation. They may be willing to work with you to come up with a settlement amount that is manageable for you. Another option is to hire a student loan debt settlement company to negotiate on your behalf.

What is known about settling student loan debt?

Image Source: pcdn.co

It is important to note that settling a student loan debt can have consequences, such as negatively impacting your credit score. It is also important to carefully review any settlement agreement before signing to ensure that you understand the terms and conditions.

Is there a solution for settling student loan debt?

Image Source: mycreditcounselor.net

While settling a student loan debt can be a temporary solution to financial hardship, it is not a long-term solution. It is important to also explore other options, such as income-driven repayment plans or loan consolidation, to help manage your student loan debt in the long run.

Information about settling student loan debt

Before deciding to settle your student loan debt, it is important to gather all the necessary information about your loans, including the total amount owed, interest rates, and repayment options. This will help you make an informed decision about whether settling is the right choice for you.

How to settle student loan debt

To settle your student loan debt, you will need to reach out to your lender or a debt settlement company to discuss your options. Be prepared to provide documentation of your financial situation, such as income statements and expenses, to support your case for a settlement.

Steps to settle student loan debt

1. Assess your financial situation and determine if settling is the right option for you.

2. Contact your lender or a debt settlement company to discuss your options.

3. Provide documentation of your financial hardship to support your case for a settlement.

4. Review any settlement agreements carefully before signing to ensure you understand the terms and conditions.

Pros and cons of settling student loan debt

Pros: Lower total amount owed, potential for debt forgiveness, avoidance of default.

Cons: Negative impact on credit score, potential tax consequences, limited options for repayment.

Conclusion

Settling a student loan debt can be a viable option for borrowers who are struggling to make their monthly payments. However, it is important to carefully consider the pros and cons before deciding to settle. It is also important to explore other options, such as income-driven repayment plans or loan consolidation, to help manage your student loan debt in the long term.

FAQs

Q: Will settling my student loan debt affect my credit score?

A: Yes, settling a student loan debt can have a negative impact on your credit score.

Q: Are there tax consequences to settling student loan debt?

A: Yes, there may be tax consequences to settling student loan debt, as the forgiven amount may be considered taxable income.

Q: Can I negotiate the terms of a student loan debt settlement?

A: Yes, you can negotiate the terms of a student loan debt settlement with your lender or a debt settlement company.

Q: How long does it take to settle student loan debt?

A: The timeline for settling student loan debt can vary depending on the negotiations and agreements reached with your lender.

Q: Is settling student loan debt a permanent solution?

A: Settling student loan debt is a temporary solution and may not address the underlying issues causing financial hardship.

Q: Can I settle private student loan debt?

A: Yes, you can settle private student loan debt, but the process may vary from federal student loan debt settlement.

Q: What are some alternatives to settling student loan debt?

A: Some alternatives to settling student loan debt include income-driven repayment plans, loan consolidation, and seeking financial assistance programs offered by your lender.

can i settle a student loan debt